Life Insurance and Living Wills – Things to Consider

What Is a Living Will?

A living will – a form of advance directive – is a legal document specifying the type of medical care1 a person wants in the event they are unable to communicate their wishes when medical care is needed.

It can be quite useful to have a living will prepared, and you should gain as much information as possible to ensure that your wishes are followed and your loved ones are cared for.

If a patient is incapacitated, suffers from a terminal illness or a life-threatening injury, health care providers may consult the living will to determine whether the patient is in favor of life-sustaining treatment. When there is no living will to consult, critical medical decisions may be made by the patient’s family (or a third party).

Living wills are typically consulted if a life-threatening situation occurs and the patient cannot communicatefor themselves. Health care providers typically do not consult living wills for standard medical care and procedures when situations are not life-threatening.

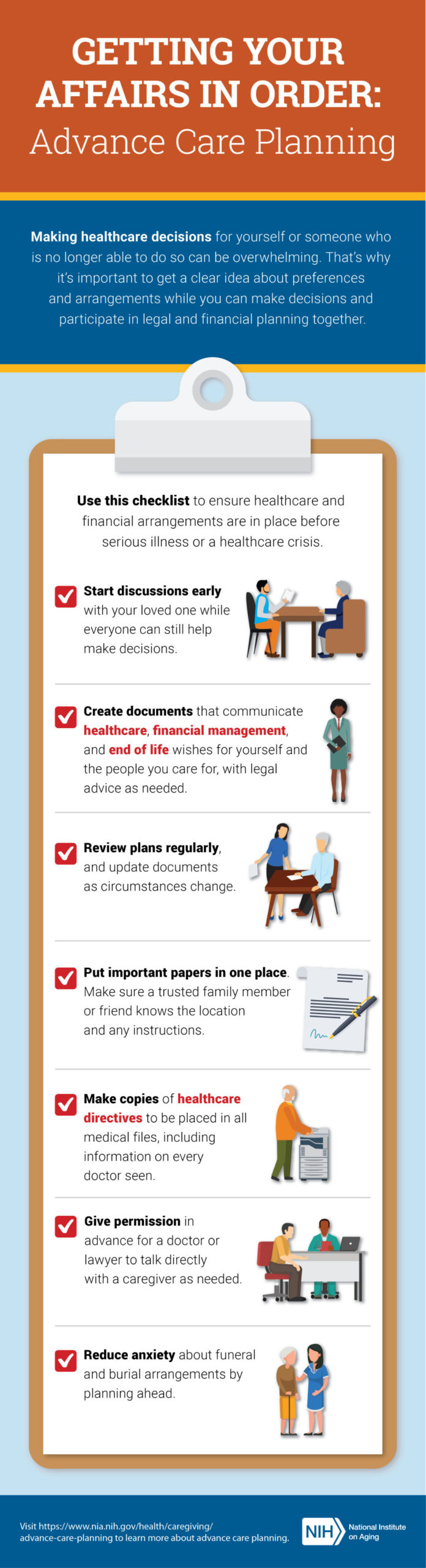

The National Institute on Aging2 recommends a couple of steps when considering advanced care planning (illustrated on the infographic below).

What’s the Difference Between a Will and a Living Will?

A will (formally known as a last will and testament) and a living will serve two different purposes.3 The first primarily provides for the distribution of a person’s assets after their death, while the latter guides end-of-life health care decisions if the person is unable to make them. For example, a living will determines what will happen to the patient in case of life-support situations.

What Does a Living Will Include?

A comprehensive living will (refer to the infographic above) addresses numerous medical procedures4 common in case of life-threatening situations. Commonly, living wills include:

- DNR orders

- DNI orders

- POLST and MOLST forms

- Organ and tissue donation

A DNR (do not resuscitate) order lets health care providers know that the patient does not wish to be resuscitated if their heart stops beating. This document may be also referred to as a DNAR (do not attempt resuscitation) or an AND (allow natural death) order.

A DNI (do not intubate) order lets the health care providers know that the person does not wish to be intubated on a breathing machine.

POLST (Physician Orders for Life-Sustaining Treatment) and MOLST (Medical Orders for Life-Sustaining Treatment) forms serve as a medical order in case of an emergency.

Organ and tissue donation forms allow the transplantation of healthy organs and tissues of a deceased person to a living person who needs a transplant. Common organs that can be donated are the heart, lungs, liver, pancreas, kidneys, corneas and skin.

A living will cannot authorize euthanasia, mercy killing or assisted suicide.

Health Care Proxy

People can choose a health care proxy5 to designate a person to make health care decisions for them if they are unable to communicate for themselves. Health care proxies may consult with health care providers for cases not covered by the living will and are sometimes a preferred option because decisions of this kind may be too burdensome for immediate family members.

A proxy can be anyone – a family member, a friend, a lawyer or simply someone who shares the person’s values about medical decisions.

Living Will and Life Insurance

Some people may wonder what happens with their life insurance if a situation in which their living will is to be executed arises. Honoring a living will doesn’t typically interfere with or impact the payment of life insurance benefits to beneficiaries.

Now, let’s consider some tips on how to maximize the benefits of a life insurance policy.

1. Beneficiaries and Proxies

Many people are familiar with the term beneficiary6 in terms of life insurance. Life insurance beneficiaries are designated by the life insurance policy owner to receive the life insurance policy proceeds when the insured dies. .

In terms of a living will, there is a proxy. The proxy may or may not be a family member, and there are no assets involved whatsoever. Because the two documents are not affected by one another, the living will proxy and the life insurance beneficiary may be different.

2. Life Insurance for All Situations

There are different types of life insurance policies. For example whole life insurance provides cash value whereas term life insurance policies do not typically accumulate cash value. Whole life insurance policies with a cash value can be a good solution for providing for the policy owner’s financial needs, and the funds can be used for any purpose.

3. Living Will and Health Care Proxy: Making It Official

Finally, simply drafting a living will or a health care proxy doesn’t make it official. It is recommended to speak with your attorney or health care provider to get an idea on what types of decisions may come up in the future and how best to structure a living will and/or a health care proxy. If you choose a health care proxy, you should fill out the legal forms.

Different states have different forms. You can look up the form for your location here or by contacting the Eldercare Locator toll-free at 1-800-677-1116. Some states require a witness for living wills and some – a notarized signature. It is a good idea to consult with an attorney before finalizing your plans and documents.

Finally, a living will is not set in stone. In fact, many people change theirs as they age since they start to get a better idea of what health issues may affect them.

Conclusion

Living wills and life insurance are not affected by one another in any way and should be considered separately. Overall, having both a life insurance policy and a living will may be helpful and recommended, and it is advisable to begin the process of considering your options with respect to these important decisions. Learn more about SBLI’s Life Insurance.

1 Cancer.org, Types of Advance Directives, American Cancer Society, 2019, accessed 1/11/21.

2 Nia.nih.gov, Getting Your Affairs in Order: Advance Care Planning, National Institute on Aging, accessed 1/11/21.

3 Ccsklaw.com, Three Key Differences Between A Living Will And A Last Will And Testament, RG Skadberg, 2020, accessed 1/11/21.

4 Money.usnews.com, Questions to Ask Before Writing a Living Will, Geoff Williams, 2020,, accessed 1/11/21.

5 Medicareinteractive.org, Medicare Interactive, Health Care Proxies, accessed 1/1//21.

6 Iii.org, What is a beneficiary?, Insurance Information Institute, 1/11/21.

This is designed for general informational purposes on the subjects covered and is not intended to be legal, tax, or investment advice. Information regarding the subjects covered may not constitute the most up-to-date available and no representations are made that the content is error-free. Further, pursuant to IRS Circular 230, it cannot be used to avoid tax penalties or to promote, market or recommend any tax plan or arrangement. You should consult your own legal, tax, or investment advisor regarding your personal situation. Policy form B-52, B-54 & B-40 series. 21-4060